whilst quite a few businesses identified themselves struggling substantial impacts as a result of the COVID-19 pandemic, lots of business people usually do not understand that They could be qualified for significant tax relief, even when they acquired resources beneath the Paycheck safety Act (“PPP”). the worker retention tax credit score (generally known as the “ERC” or “ERTC”) is actually a refundable tax credit history for organizations that retained their staff members through the COVID-19 pandemic. companies are eligible to say the ERC if both: the company was possibly totally or partially suspended due to a COVID-19-associated federal government buy; or, the business’s gross receipts in a very calendar quarter declined by a lot more than 20% when compared to the same quarter during the former year.

The ERC was to begin with passed as Section of the Coronavirus support, aid, and Economic protection (“CARES”) Act in 2020, and delivers qualified businesses with a credit score in opposition to specific employment taxes.

For 2020, the ERTC was accessible for fifty% in the wages compensated nearly $10,000 for each personnel, capped at $5,000 for every employee. For wages compensated soon after January one, 2021, and in advance of Oct one, 2022, the ERTC can be applied to 70% of qualifying wages of nearly $ten,000 for each quarter — a most of $21,000 for every personnel as a result of September 30, 2021.

competent wages contain wages and wellness program costs paid out to suitable staff concerning March twelve, 2020, and December 31, 2021. Eligible workforce include things like people that were retained and paid through a qualifying period, irrespective of whether they were being actively Operating or not.

businesses searching for to say the ERC for 2020 will have to post documentation by April 15, 2024. Claimants for 2021 must submit their statements by April 15, 2025.

How Can My business enterprise Claim The ERC?

declaring the ERC is complex, and several entrepreneurs don’t realize They could qualify. Even organizations that remained operational throughout the pandemic can qualify to say the ERC if government orders resulted in company interruptions that made even a partial shutdown of functions.

This system is directed at little organizations that confronted sizeable financial adversity in 2020 and 2021 as a result of the COVID-19 pandemic. The credit could be worthwhile to businesses who are battling to keep up their workforce, but There are some stipulations. In 2020, a business could acquire as much as $5,000 for every worker. By 2021, businesses will get 70 % of qualified wages compensated to workers, up to $28,000 for every worker.

exactly what is the speediest Way to assert The ERC?

The ERC can be a beneficial way for companies to recoup pandemic-era losses in profits, protected funds stream for expenses, and provide All set money For brand spanking new alternatives. on the other hand, IRS processing of ERC claims can often consider as much as 8-twelve months.

having said that, for firms looking for to Get better their ERC money on an accelerated timeline, an ERC Bridge mortgage (generally known as an ERC Advance financial loan or ERC personal loan) can be certain total or partial funding of an ERC assert within a duration of weeks, not months.

Working with a trustworthy, seasoned supplier can assist in order that your ERC declare is error-totally free, accurate, and processed proficiently. At ERTC Funding, our group of pro analysts do the job to ensure your claim is total, backed by exhaustive lawful exploration, and funded on your own timeline – we've been your partners at just about every stage of the process. Our partnerships can help you to receive nearly 90% of the claim as rapidly as you can through an ERC Bridge personal loan, permitting your organization the pliability to fund working day-to-day costs and make the most of possibilities since they come up.

How Can ERTC Funding support My enterprise Process Its ERC declare speedily?

ERTC Funding’s staff of industry experts will examine every single facet of your declare, and be certain that you are acquiring the most credit rating that you are entitled to. Moreover, ERTC Funding can assist you to finance your declare swiftly, enabling your compact small business to get an ERTC progress or ERTC Bridge personal loan — you’ll obtain as much as 90% of one's cash inside months, not months.

An ERTC progress (also referred to as an ERTC Bridge or an ERTC Loan) is a short-time period personal loan that may be used to make the cash from a pending software for that ERTC available to your enterprise instantly. An ERTC progress can make sure your enterprise has the All set hard cash to function and prosper, and eradicates the necessity to hold out for presidency approval within your software.

by strategic partnerships, ERTC Funding can progress you around ninety% of one's anticipated ERC declare in just 2 months.

envisioned Time: This stage usually takes a number of months, based upon how speedily the necessary paperwork is usually well prepared and finished.

do you think you're prepared to Get Started website On Your ERC assert these days?

Claiming the ERC could be really complicated, and having your declare wrong can have significant effects. With nuanced guidelines to abide by, a variety of checks to use, and comprehensive Evaluation necessary to make an suitable and compliant claim, not each and every ERC organization is provided to offer the substantial amount of services necessary.

At ERTC Funding (ertcfunding.com), supporting you improve your lawful ERC declare is our mission. Doing so by using a compliance-concentrated, depart-no-stone-unturned strategy is exactly what makes the difference between the average ERC services company and one that cares deeply about carrying out matters the right way in the interest of its clients.

Get hold of us right now to get started!

Val Kilmer Then & Now!

Val Kilmer Then & Now! Elisabeth Shue Then & Now!

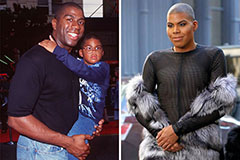

Elisabeth Shue Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Justine Bateman Then & Now!

Justine Bateman Then & Now! Mike Smith Then & Now!

Mike Smith Then & Now!